When people talk about the future of warfare, their minds tend to go big.

Some picture Star Wars-style weapons—laser-guided, voice-activated, plasma-something. Others imagine fully autonomous killing machines, à la Terminator. And of course, the Palantir crowd: war turned into a real-time dashboard, with generals watching from glass towers, sipping espresso while AI predicts the next insurgency.

They’re all right. And all wrong.

Because yes, war is becoming more automated, more AI-driven, more robotic. But it’s not just about the big toys. The real shift is happening in the margins—where the machines are small, cheap, smart, and everywhere.

Drones.

Look every conflit around the world, they’re no longer a footnote, they’re no longer “support.” They are the new strategy and the new tactic and of course, they’re are on the front line. And today, we’re diving into one of the companies quietly arming this future. But the thing is: it’s not in Silicon Valley nore in Shenzhen.

In Paris.

Let’s talk about Parrot.

💻📈 Company Overview

🔤 TICKER: PARRO – Euronext Paris 🔢 ISIN: FR0004038263

If a drone company could blend French aerospace heritage with hacker startup vibes, it would be Parrot. Founded by Henri Seydoux in the pre-iPhone era (1994!), this Paris-based misfit somehow survived the GoPro wars, pivoted out of consumer drones, and is now building flying robots for governments. Oui, monsieur.

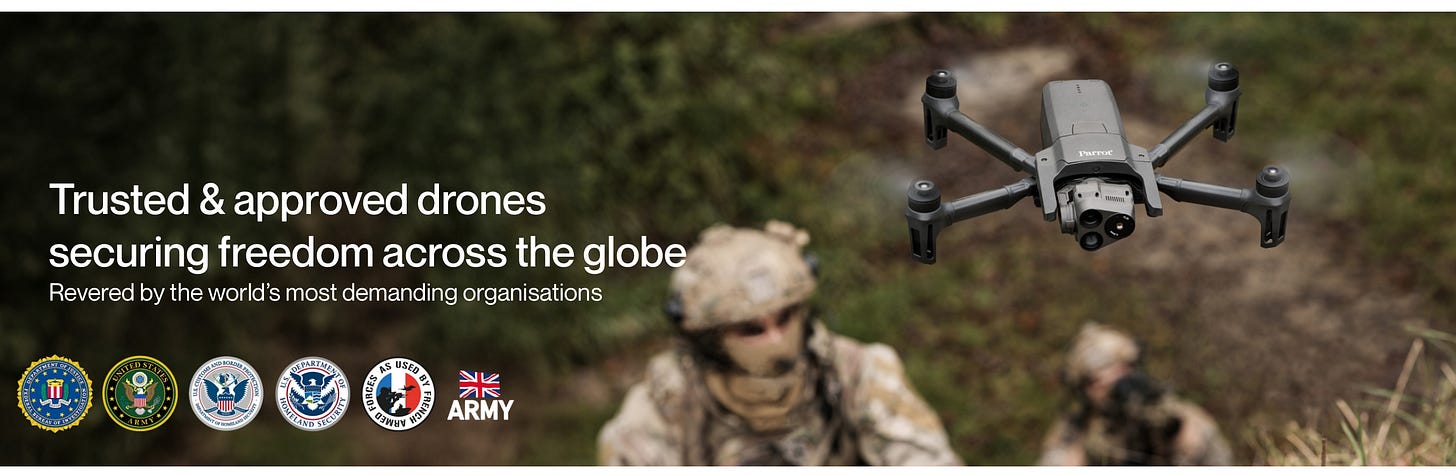

We’re talking professional microdrones—rugged, open-source, secure by design—deployed by the military, cops, firefighters, and surveyors. Oh, and they make the software too. Their photogrammetry suite, Pix4D, turns drone footage into 3D models used for agriculture, infrastructure, and yes, battlefield intel.

Today, Parrot is Europe’s leading commercial drone player. It’s small (€78m in revenue in 2024), but profitable in H2, cash-positive, and officially on the Pentagon’s “Blue UAS” list. That last bit? It’s like being knighted by Uncle Sam—an open invite to the U.S. defense gravy train. Not bad for a company still run by its original founder, still headquartered in Paris, still flying under most radars.

Financial, Assets & Strategic Overview

— Revenue Growth & Stream Mix, Profitability Margins, and Infrastructure Investment

Revenue Growth & Stream Mix

Parrot pulled in €78.1 million in 2024, up +20% vs 2023. Not exactly Nvidia territory, but for a French drone company in a sector known for R&D black holes and bureaucratic procurement cycles that’s solid. Zoom in, and it’s not just topline fluff:

The microdrone business exploded +45% YoY, hitting €48.1m, now 62% of total revenue. That’s the ANAFI effect—especially the USA model, which became the Pentagon’s new crush.

Photogrammetry—the software side, mostly under Pix4D—shrunk slightly (-6%), but for good reason: SaaS transition. Deferred revenue is up, and adoption of new tools (like PIX4Dcatch) is gaining ground.

Profitability & Margins

Parrot’s second half of 2024 can be defined as profitable. First half is still bleeding. Overall EBIT for the year: -€7.3m vs -€30m in 2023. That’s not just “less bad,” that’s a real trajectory toward break-even.

Gross margin sits at a healthy 74.1%, thanks to software leverage and smarter hardware production. They are turning data driven which is exactly what we want to see.

Operating expenses dropped 11% across the board. R&D still heavy (€39.7m), but it’s focused on the right battles: AI, cybersecurity, defense specs. Again, that’s the battle we want to see.

Cash & Backbone

€33.6m in cash at year-end, up from €28.1m in 2023. And no short-term debt in sight. Net cash (ex-IFRS 16) at €24.8m.

Production moved out of China (it was a big concern), ramped up in South Korea. Industrial ops are leaner, faster, and under control. Oh—and a fun twist: Parrot owns its full stack: so I mean hardware, software, distribution, even cloud deployment. That’s rare in defense tech, and it gives them serious agility when tenders pop up or when the DoD wants a custom firmware patch, like, yesterday.

Infrastructure & Strategic Investment

« How do you scale in defense without blowing up? » You build right.

Parrot, plus building and selling drone, are also building an integrated defense tech platform — and they’re doing it like engineers, not like marketers.

Forget the “French drone company” cliché (Drone Volt story) . What Parrot is actually building is a sovereign, interoperable, secure-by-design flying system (it’s trendy in Europe right now)— hardware, software, cloud — ready for NATO-grade deployments. And they’re doing it from Europe. With real code, real gear, and real contracts.

Let’s break it down:

The ANAFI platform is now modular, export-compliant, and cleared by the U.S. DoD (Blue UAS). That’s the military tech equivalent of being whitelisted by both Apple and Android. It signals trust, robustness, and strategic optionality.

Open-source architecture — which means faster integration into existing ecosystems, from tactical command systems to field devices. It’s like having a drone fleet that speaks fluent API.

Cybersecurity built-in, not bolted on. The whole product stack is hardened, encrypted, and audit-friendly. A critical feature when your client isn’t a vlogger, but a special forces unit.

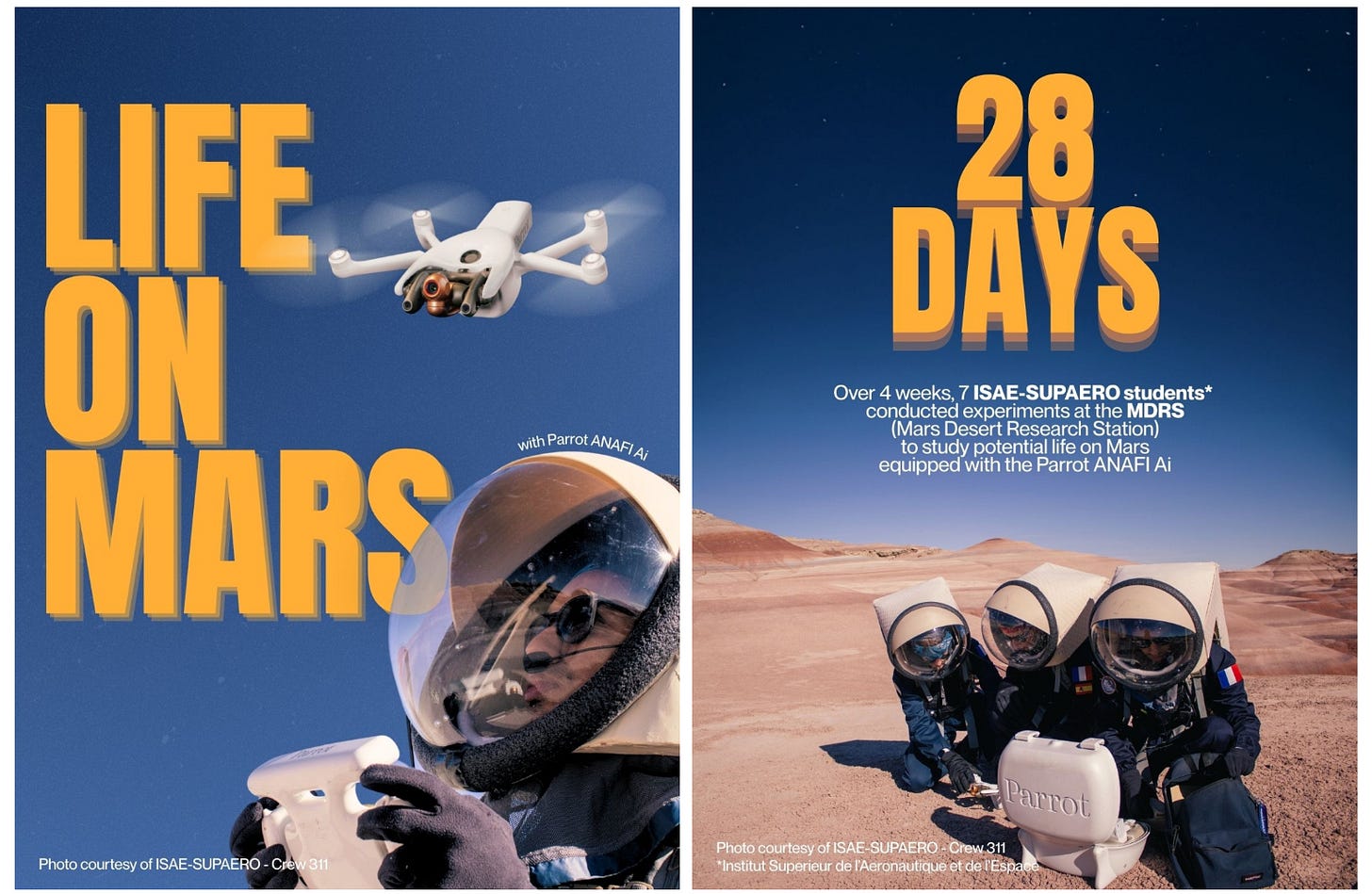

They are preparing Mars mapping.

And they’re not just hardware peddlers. The Pix4D suite is becoming a battlefield tool — turning drone footage into real-time 3D maps, simulating impact zones, measuring terrain with centimeter precision. It’s used in agriculture, yes. But also by NATO engineers planning post-strike clearance.

Infrastructure side, they’ve cleaned house.

Production fully moved from China to South Korea.

Logistics agile enough to adapt to U.S. customs chaos.

Field teams active in Eastern Europe, Brazil, Japan — selling not slides, but gear.

And maybe the smartest move? They kept it focused. No AI-for-the-sake-of-it, no moonshot drone taxis. Just execution on what militaries actually need: small, smart, secure flying machines. Don’t get me wrong, Parrot isn’t trying to be Palantir. They’re trying to be useful, and they are. And that’s infinitely more valuable when the war budget hits €2B and you’re one tender away from hypergrowth. R&D stays heavy (50% of revs), but for once, it’s not a cost center. It’s a moat. The ANAFI line isn’t a consumer gadget anymore—it’s a secure, modular platform cleared by the Pentagon. That changes the game.

Strategic Tailwinds — What’s Actually Fueling Parrot’s Rise

1. A Soaring Military Drone Market

The backdrop couldn’t be more favorable than today:

The global military drone market is projected to grow from roughly $15–20 billion in 2024–25 to anywhere between $21 billion and $57 billion by 2030–33, with CAGRs spanning 7–14% depending on the source.

One forecast even sees global drone spending doubling in the next decade amid Russia-Ukraine, Middle East tensions, NATO armament — a megatrend rather than a flash.

Parrot is sitting on a multi billion market opportunity.

2. Europe & North America: Fastest-Growing Zones

North America’s drone market is expected to reach $62 billion by 2030 (13.5% CAGR) .

Asia-Pacific, also a rapidly expanding theater, is growing at +15% CAGR, signaling new demand outside Parrot’s backyard.

Europe’s military budgets hit €326 billion in 2024, with a significant share earmarked for UAVs. That’s where Parrot’s EU-native credentials carry weight.

3. “Combat-Proven” Is the New Currency

Ukraine has catapulted drone warfare into mainstream military doctrine. Over 1.3 million drones were deployed in 2024, making battlefield validation a new badge of honor.

Firms like Parrot and Delair are field-testing regularly in Ukraine, fine-tuning their platforms against electronic warfare, accuracy demands, and fast adaptation. That’s a huge moat for buyers.

4. DJI Bans & NATO-Grade Demand

Following widespread concern over DJI’s Chinese-made drones, allied militaries are shifting to trusted, compliant suppliers. Parrot is uniquely positioned: EU-based, Pentagon-cleared (Blue UAS), and cybersecure-by-design. Surveys expect Parrot’s market share in surveillance-friendly, NATO-aligned environments to jump from 5% to 9%—a tangible uplift.

5. Enterprise & Dual-Use Adds Optionality

The broader commercial drone market is booming too—$73 billion today, heading to $164 billion by 2030 (14.3% CAGR). I focused the article on the defense aspect of Parrot but they also are in commercial drones. Let’s not forget that.

Parrot straddles both worlds: battlefield mapping one day, infrastructure inspection the next. Pix4D photogrammetry tech brings defence-grade accuracy to agri, surveying, oil & gas—market multiplier.

At Some Point, Why It Powers Parrot

In my view there are 4 main thing we must keep in mind from all of that:

The market expansion: military budgets rising, drone fleets multiplying, NATO’s digital pivot accelerating.

The tech validation: combat-proven builds trust—and high barriers for newcomers.

The geopolitical trust play: Western buyers seek non-Chinese hardware; Parrot fits the bill.

And finally, the dual-use growth = upside optionality: not single-use defense—versatility boosts valuation.

Is Parrot your next growth stock? Is it truly a Hidden Market Gem? Still lot of interesting thing to say about this stock. Let’s see.

Keep reading with a 7-day free trial

Subscribe to Hidden Market Gems to keep reading this post and get 7 days of free access to the full post archives.