Glintt — short for Global Intelligent Technologies — is one of those obscure names you’ve never seen on a Bloomberg terminal, and that’s exactly why it deserves a closer look…

Welcome to 🧿 Hidden Market Gems, the newsletter that dig up stocks that are under-the-radar — and tell you why they’re worth watching or even buying, without boring the hell out of you.

💻📈 Company Overview

🔤 TICKER: GLIT • Euronext Growth Lisbon 🔢 ISIN: PTGLT0AE0002

Founded in 2001 near Lisbon, Glintt is the kind of under-the-radar company quietly building critical parts of modern economies. Not glamorous. Not loud. Just solid.

They provide high-value IT services for essential sectors: healthcare (where they’re a heavyweight), financial services, telecoms, energy, and public administration. In Portugal and Spain, they dominate healthcare IT — think hospital management systems, e-prescriptions, pharmacy networks. Glintt doesn’t just sell software — they embed themselves deep into critical operations. When your systems run hospitals, banks, and energy grids, you don’t get swapped out every two years. It’s a real business, solving real problems, in real economies — and almost no one outside Portugal is paying attention. Exactly the kind of overlooked compounder we love to hunt.

Honestly, if this were listed in Stockholm, people would be all over it. But it’s Portuguese, under the radar — and that’s exactly our kind of story. Alright, enough prestation. Let’s dig into Glintt.

Financial, Assets & Strategic Overview

— Revenue Growth & Stream Mix, Profitability Margins, and Infrastructure Investment

Revenue Growth & Stream Mix

Sales Growth:

In FY 2023, Glintt posted €120.2M in revenue, up +6.7% YoY. Not explosive, okay, but steady. What’s behind it? Organic growth, mostly — no headline-grabbing acquisitions, no financial wizardry. Just gradual expansion of its core healthtech services, especially in Portugal and Spain. Especially is a little saying. Glintt is highly concentrated in Spain and Portugal… I mean it’s okay if you want to be exposed to these markets, but so you know:

In Q1 2024, revenue dipped slightly to €29.78M (–1.3% YoY). Early days — one quarter doesn’t make a trend, but it’s worth keeping an eye on if you ask me.

Recurring vs. Contract Revenue Mix:

Not disclosed directly, but here’s what we do know:

Glintt is heavily embedded in hospital systems and health administration infrastructure. That means long-term contracts, high switching costs, and regular service/maintenance fees. In other words: it’s recurring in practice, even if it’s not labeled as such.

Segment Breakdown:

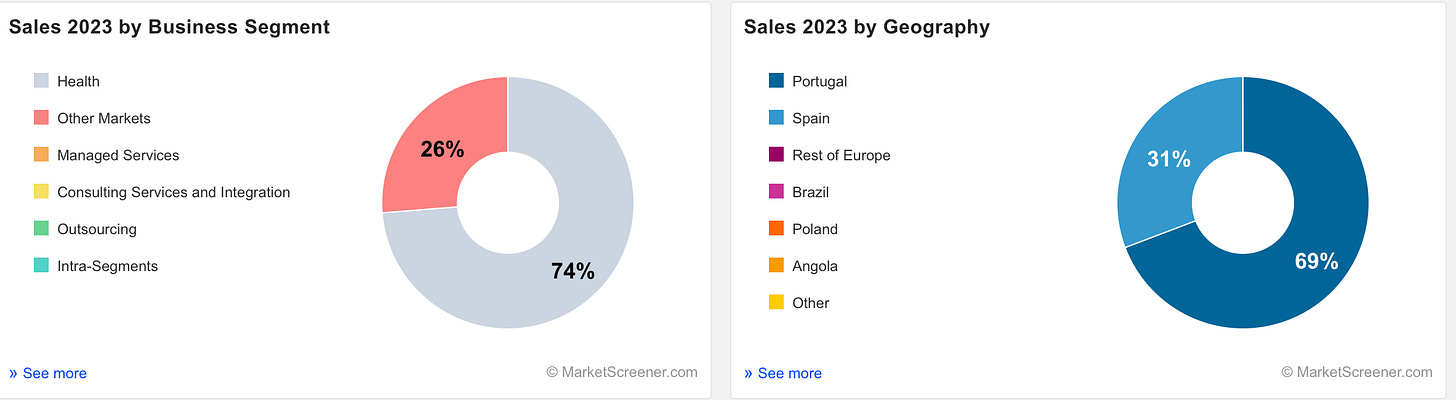

(From MarketScreener and company reports).

Healthcare IT Solutions (core business): software platforms, data integration, electronic prescriptions, AI-enabled diagnostics. It’s 74% of business!!!

Consulting & Managed Services: digital transformation for public and private healthcare. (26% remaining).

Iberia-focused delivery: Portugal is the home turf, Spain the expansion playground. (26% remaining).

Conclusion on it:

Steady top-line + sticky B2B healthcare contracts = a compounding, reliable base. But it’s not a Swedish compounder, it’s in the making, and it’s in the price….Glintt isn’t growing like wildfire, but we cannot take from them that it’s rooted deep in systems you can’t unplug easily. Again, highly concentrated in healthcare…

1300 already in. You in too? Consider subscribing.

Profitability Margins & Asset Investment

Margins:

Glintt turned in decent profitability in Q1 2024:

Gross Margin: 64.5% (!!!) — that’s very high, even by software standards.

EBITDA Margin: 10.6% — solid for a services-heavy business… it’s okay.

Net Profit: €1.47M, up from €0.92M YoY.

Net Margin: 3.8% — thin, but improving…

Free Cash Flow Margin: 12.9% — quietly strong.

This is a capital-efficient model. High gross margin shows pricing power and cost control; the lower net margin reflects a business still investing in its platform, people, and footprint… Let them time. It was formed after the merging of ParaRede and Consiste. So let them time.

➕ Assets: Total assets hover around €100M (est.), mostly intangibles and receivables — classic for a tech & services company. No heavy infra, no big warehouses — Glintt is lean. It’s software.

➖ Debt: Net debt is modest. The company has been deleveraging gradually, with no signs of overextension. Interest rates in Europe are easing, so refinancing risk is also declining. No big red flags here if you ask me. This is not where your attention should be.

Innovation & Tech Investment

In a nutshell:

Glintt doesn’t go shopping for tech DNA — it builds it in-house. And that’s important to notice that for the thesis. 2024 was a turning point: they launched a Generative AI Center of Excellence, focused on one thing — embedding real AI into the everyday workflow of hospitals and health systems. Click on this button to know more:

So, I looked at it: no AI fluff hopefully. But real, clinical-use-case AI:

Smart diagnostics, (the future if you ask me)

Admin automation, (even more the future, cause it’s a mess)

Patient triage optimization.

Glintt knows something most others don’t: clinical data is gold, and healthcare is one of the few legacy sectors where AI can deliver immediate, measurable value.

Ok we are done with investing. Haha I am kidding we are not, they’re also investing in:

Medical cloud infrastructure (Glintt Next, Glintt Life)— secure, scalable, healthcare-native.

Data interoperability platforms — breaking silos across hospital systems. (Gold).

Vertical SaaS for healthcare (Glintt Life) — low churn, high margin, and ultra-sticky.

Here, Glintt is saying « we know what the market need (product market fit) and we are building cumulative innovation inside a highly regulated, high-barrier sector »….

In case you don’t speak the same language as us:

==================== « We are building a MOAT » =====================

And… here we are, that’s why this company is worse watching.

Market Position & Competitive Landscape

Glintt plays a local dominance game. I like this kind of game, because that’s the kind of game that brought Amazon where they are today. First books, once they reach a monopolistic position, they expand. Are they scaling? No. They’re not scaling like a rocket. I think that they’re embedding themselves deeply into public and private healthcare systems — starting in Portugal (where they cover 85%+ of hospitals, can you believe it?), and now increasingly in Spain. After that? Boom. Other countries, other markets, other verticals. But again, give them time.

Their edge you ask me?

Deep sector expertise (tech + pharma + admin = sweet spot). $1B boring idea.

High trust in mission-critical software… We are directly connected to people’s life condition, so you can’t f*** around.

Integration-first mindset (they don’t « disrupt » as people like to say (without knowing the definition lol) — they upgrade).

To put it in simple words: Glintt’s team is not selling “an app for healthcare.” They’re selling the invisible backbone that keeps hospitals running: from prescriptions to data layers to AI modules. Trust this field needs it really much. Imagine the numbers of life we can save faster, better, with this kind of solution fully integrated? And they don’t need to invent markets. Their existing market is under-digitized and underserved, but changing fast — pushed by EU funding, post-COVID urgency, and structural reform in health infrastructure…

So, here’s the thing:

Scalable model (SaaS + consulting) (this should trigger you at some point).

Low capex

And a regulatory moat that scares off casual competitors.

Imagine: SaaS + Moat + High Barrier Entry (regulations) + prove itself in pilot country, is expending. But here’s the thing:

Yep, that’s bad.

— « Hidden Market Gems, I don’t know why you make me waste my time with this kind of shitcoin »

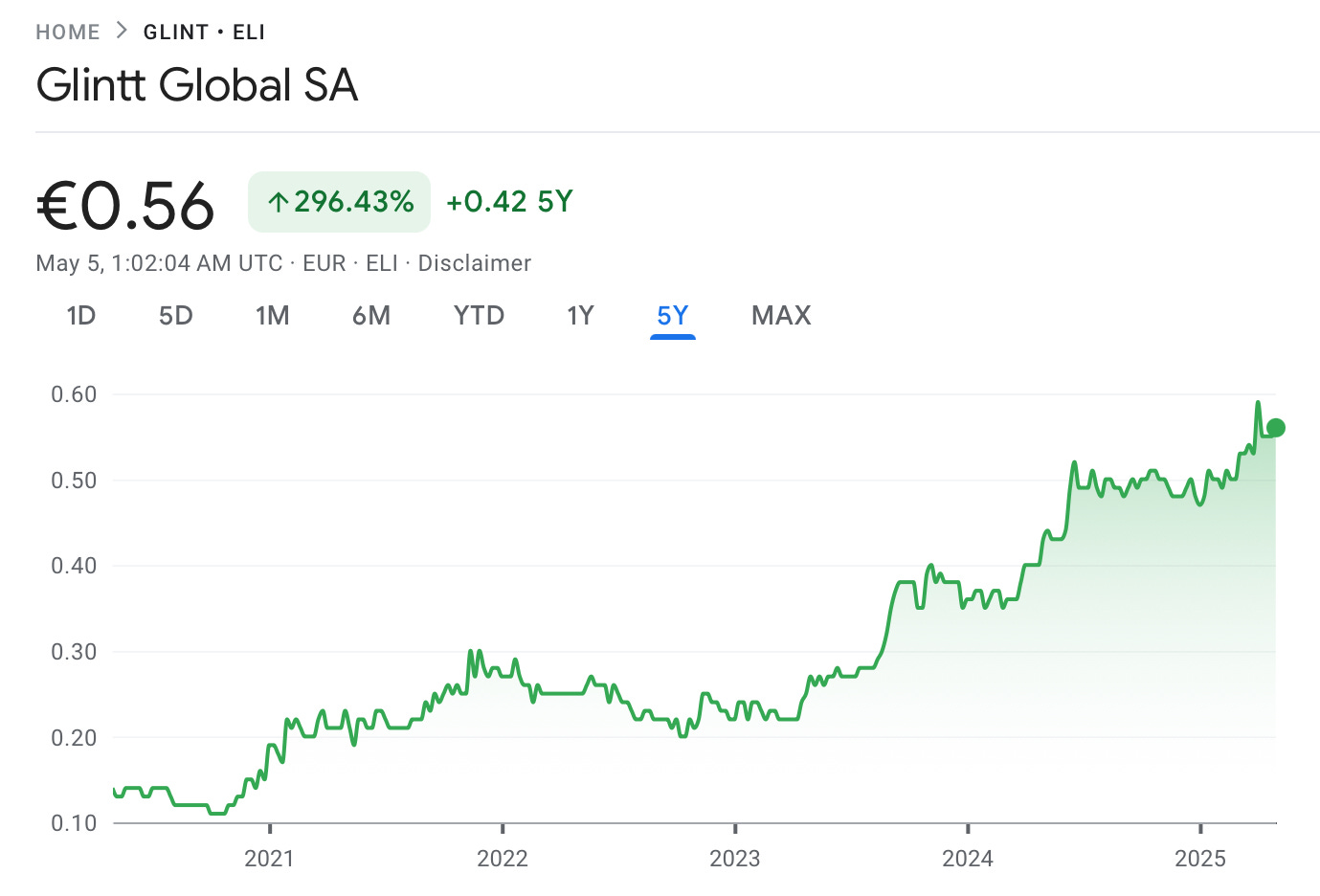

— 🧿 Listen to me: you’re looking at a stock that went from over €5 to €0.56 in 20 years. That’s a 90%+ drop, followed by a flatline since 2010. And your first reaction?

— “Why the hell would I put a single euro into this thing?”

But don’t stop at the chart. Because in my opinion and from my experience, these long-decline visuals are often hiding something, something that is hard to believe, not hard to see:

A legacy business model from pre-2010, + hard time recover from dot com bubble.

….So a company that took a decade to pivot, slowly

And one that finally found its angle — but the market hasn’t caught up yet.

And if you stop judging and start to understand, Glintt in 2005 is not Glintt in 2024, because the company has:

Changed its name …

Focused entirely on digital health …

Cleaned up its balance sheet …

And started generating stable cash with healthy margins. So that’s a different narrative now. Here’s what I see: the market is waiting for signals, but it’s not looking at the right place. Me? I look at sub signals. The company is becoming data driven, AI-driven, multi dimensionally data driven, and that’s another story.

Competitive Landscape

Let’s be honest: Glintt doesn’t compete with Big Tech. They’re not trying to be Epic, Oracle Health, or Siemens Healthineers. That’s not their lane. They operate in the cracks those giants do not focus on — mid-size hospitals, public health networks, and legacy infrastructure that still runs on Excel sheets and PDFs. The kind of clients who don’t need a spaceship, but just a system that works, plugs in, and doesn’t break under pressure… Their real competition in Portugal?

Local IT vendors ; Fragmented consulting firms ; In-house tech teams held together with duct tape…

And that’s where Glintt has the upper hand I think, because it’s basically:

End-to-end offering (software + integration + support)

20+ years of track record

Deep domain expertise in healthcare ops, not just tech

In Spain however, competition is slightly stiffer (Dedalus, GMV, local integrators), but none of them has Glintt’s combo of healthcare-specific software + long-term services + boots-on-the-ground delivery. This isn’t a market where you scale fast — it’s one where you outlast, and that’s why the 90% drop might just be a hazardous episode and not an ending in itself. Just my opinion. I am risk proof you know that.

📈 Opportunities I Identified — Why Glintt Might Be a Hidden Compounder

Glintt looks like a zombie stock at first glance — but under the hood, it’s quietly starting to compound. Revenue is growing, margins are clean (64.5% gross, 13% FCF), and the core business is deeply embedded in the healthcare systems of Portugal and Spain. No hype, just hospitals that renew contracts year after year after year after year. Churn rate is radially important, and those guys seem to know it.

They’re not scaling fast that’s true — they’re digging deep, slowly. And now, they’re layering AI into their tools, not to impress VCs, but to solve real pain points in diagnostics and hospital workflows. It’s not a story stock — it’s a cash-flow machine that trades at 15% FCF yield. That’s rare. Would you take the risk though? Let’s find out:

🗡️ Threats I Must Underline — Why It’s Still Cheap

The chart is ugly, the stock is illiquid, and the brand still smells like 2008. Growth dipped slightly in Q1, and the Spanish expansion will test their execution skills. No dividend, no buyback — just reinvestment.

Ok, we’ve seen a lot of things, now let get to the conclusion and why I would do with this company. Is this a 2x or a 5x like I said in the title? Let’s see:

(It’s for Paid Subscribers, you should consider become one too).

Keep reading with a 7-day free trial

Subscribe to Hidden Market Gems to keep reading this post and get 7 days of free access to the full post archives.