📢 Announcement #2:

Time to say more:

I’ve been working on something quietly these past two months. Not a post. Not a portfolio. A thesis.

It started with a question I couldn’t shake: how do you spot the next Amazon or Nvidia before they blow up? Not once they hit every screen, but when they’re still invisible to the crowd — just a blip, just a weird outlier on a messy spreadsheet.

So I started digging. Testing. Connecting dots across time, across companies, across market cycles. I wasn’t looking for a narrative — I was looking for a structure, a template. A kind of fingerprint. And little by little, something started to emerge.

Today, for the first time, I’m showing you what it looks like.

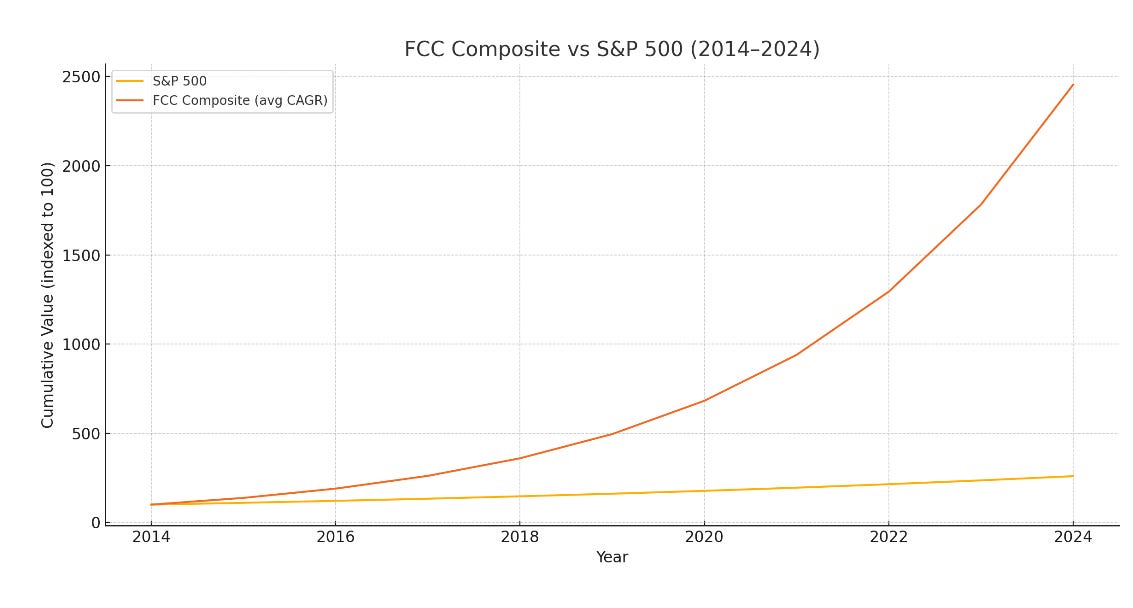

That orange line in the chart? That’s not the S&P 500 (in yellow). That’s what I’ve started to call the ‘FCC Composite’ — a simulation based on the companies that would’ve matched this thesis over the past decade.

10x outperformance.

Not with leverage.

Not with timing.

Just with selection.

Now — I’m not launching anything today. Not yet. I’m still pressure-testing the model, fine-tuning it, making sure it’s not just curve-fitting dressed in shiny metrics. But the early real-time results? They’re encouraging. Some names are already up +22%, +28%, even +30% since being flagged. And I didn’t even publish them yet..

So yes — this might be something big. For me, and for this newsletter.

In the coming weeks, I’ll probably launch a first iteration. It won’t be open to everyone. There will be a limited number of seats as I said, because I want this to be built slowly, with intention — not as a hype train. Those who checked my profile recently spotted the new newsletter; there is nothing on it, yet.

And when it drops, I’ll also start sharing a bit more about me. Why I care about this. Why I built it in the first place. Yes, the mask might vanish. If that sounds like something you want to be part of — I’d suggest you subscribe now. Or maybe stay tuned.

Because when it goes live, it won’t stay quiet for long. 100% serious.

Anyway, this week in the vault:

🧿 Buys This Week / Next Week

Again guys, nothing this week but Monday here’s what I’ll buy.

(Buy Monday) Lemonade ($LMND)

Still super asymmetric at these levels. $1.2B market cap for a business sitting on $1.2B in cash and equivalents, with 20%+ gross loss ratio improvement YoY. AI-native infra finally scaling — renters profitable, pet and life not far behind. They’re not playing Wall Street’s game, but they’re still in it. Buying 10 shares Monday.

Keep reading with a 7-day free trial

Subscribe to Hidden Market Gems to keep reading this post and get 7 days of free access to the full post archives.