Hey folks, I hope you and your portfolio are doing well.

Today, as part of my non official series of ‘I give my opinion about random things’ I wanted to talk about the massive thing that is around the corner, the elephant in the room. Winter is coming, but with Climate Market Change, I don’t know when.

Yes, we are clearly in a bubble. The AI bubble (what a time to be alive!!). In this article I will do a bit of economics (because I love it in fact, *sad* even if it’s not as sexy as playing saxophone). The goal is to explain, what is bubble (with historical example), how does it happen, why we never know when it will explode (even if we know it’s coming), and of course what to do about it.

So first, let’s clear the air: what the hell is a bubble?

A bubble is basically when prices detach themselves from reality, clearly, like Elon Musk’s tweets at 3 AM. Think tulips in 1637, dot-coms in 2000, housing in 2008. The script is always the same: everyone sees the upside, nobody sees the cliff. People start buying not because the thing is fundamentally good, but because they believe someone else will pay more tomorrow. That’s not investing, that’s hot potato with extra zeroes, that’s Palantir trading at 520 earnings.

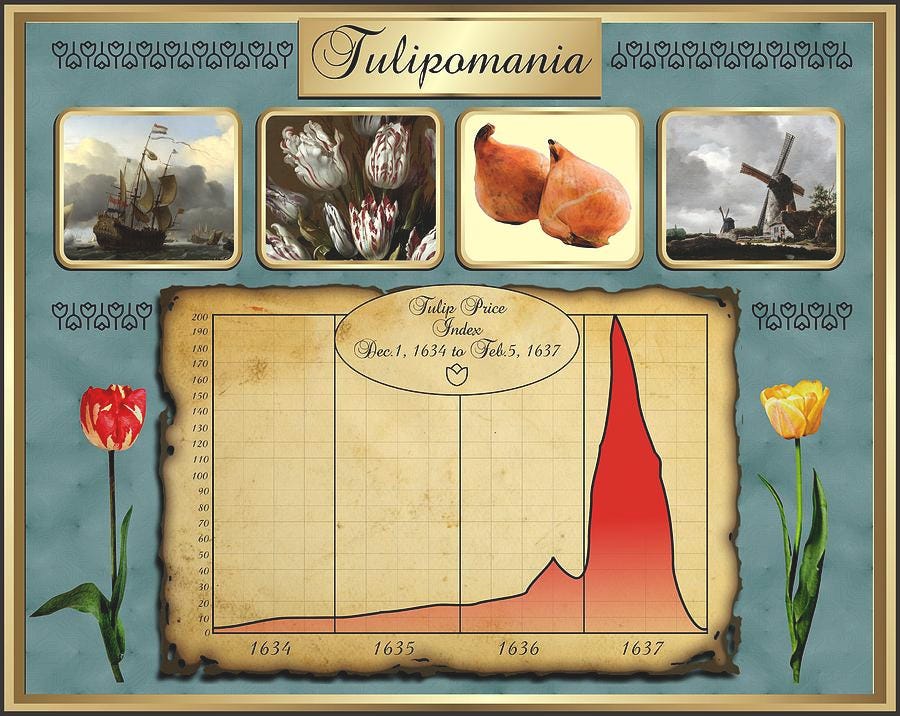

Let’s go back in history, precisely too much years ago:

Netherlands, 1630s. The country is booming, trade is flowing, Amsterdam is basically Wall Street on steroids. And in the middle of that wealth, people go crazy… for flowers. Tulips. Yeah, those colorful things you buy at Monoprix for €5 the bouquet.

Why? Two reasons: rarity and status. Some tulip varieties had exotic patterns (caused by a virus, by the way) that made them unique. Owning one bulb was like driving a Ferrari parked in front of your house today. Except Ferraris don’t multiply underground. Tulips do.

So, naturally, speculation kicked in. Prices started going up. People who have no idea about flowers start buying, not because they have a new passion for gardening, but because they think they can flip the bulb to the next guy. Farmers, merchants, even barbers join the party. Contracts to buy tulips months later (proto-derivatives!) are traded like crazy. At the peak, a single rare bulb could be worth the price of a nice canal house in Amsterdam. Madness.

And then (as always) someone realizes “wait… this is just a flower.” Buyers dry up, confidence collapses, prices crash in weeks. People who thought they were rich are suddenly ruined. Welcome to Tulip Mania, the first documented financial bubble.

Lesson? Human psychology hasn’t changed in 400 years and this for a lot of matter... Anyway, we dress it up in AI, crypto, dot-com, real estate… but the pattern is the same: scarcity → hype → speculation → crash.

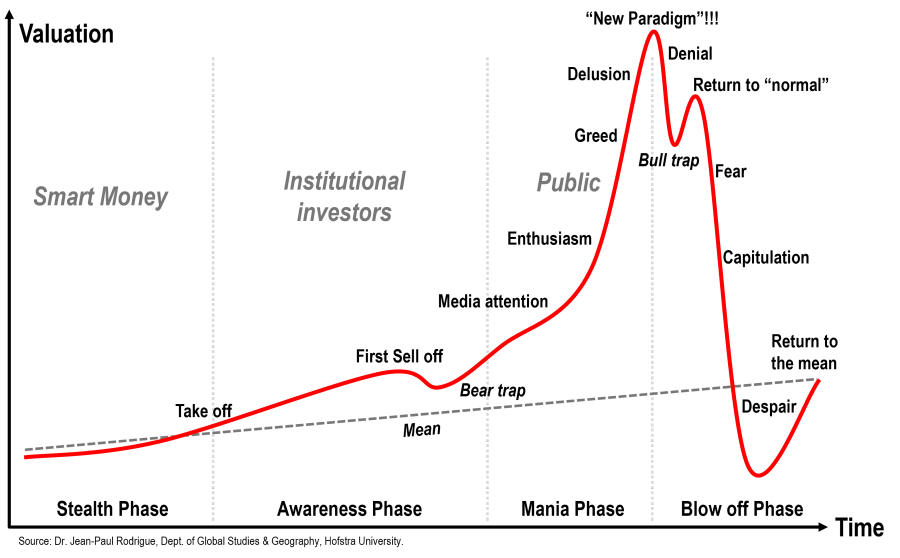

Now, how does it happen concretely? Easy. Human beings, we are dopamine junkies. You see your neighbor getting rich on crypto, AI stocks, or whatever shiny new toy is in town, and suddenly your ETF looks boring. So you jump in. Prices go up, more people jump in, prices go up again. Feedback loop. Until, one day, the music stops (saxophone is not sexy anymore) and if you’re still holding the potato, well, it’s not warm anymore, it’s rotten and nobody want your rotten potato, but veggie french fries.

The fun part in all of this? The timing my dear friends. Timing a bubble burst is impossible. Everyone knows it will happen, nobody knows when. Alan Greenspan saw the dot-com bubble three years before it exploded. Michael Burry shorted housing two years too early. John Maynard Keynes, one of my favorite economist of all time said it best:

“Markets can stay irrational longer than you can stay solvent.”

Translation: even if you’re right, you can still go broke waiting. Like I am with Figma.

So back in 2025, what do we do about the AI bubble?

Keep reading with a 7-day free trial

Subscribe to Hidden Market Gems to keep reading this post and get 7 days of free access to the full post archives.