5 Undervalued Stocks to Watch in 2025

🗞️ You should have a look at this list …

Hey Guys, Hidden Market Gems here! Today, we're diving into some market gems that, despite their modest valuations, show serious potential for a rebound in 2025. If Mag7 really start to bother you and you're looking to spice up your portfolio, here are a few companies that might just catch your interest.

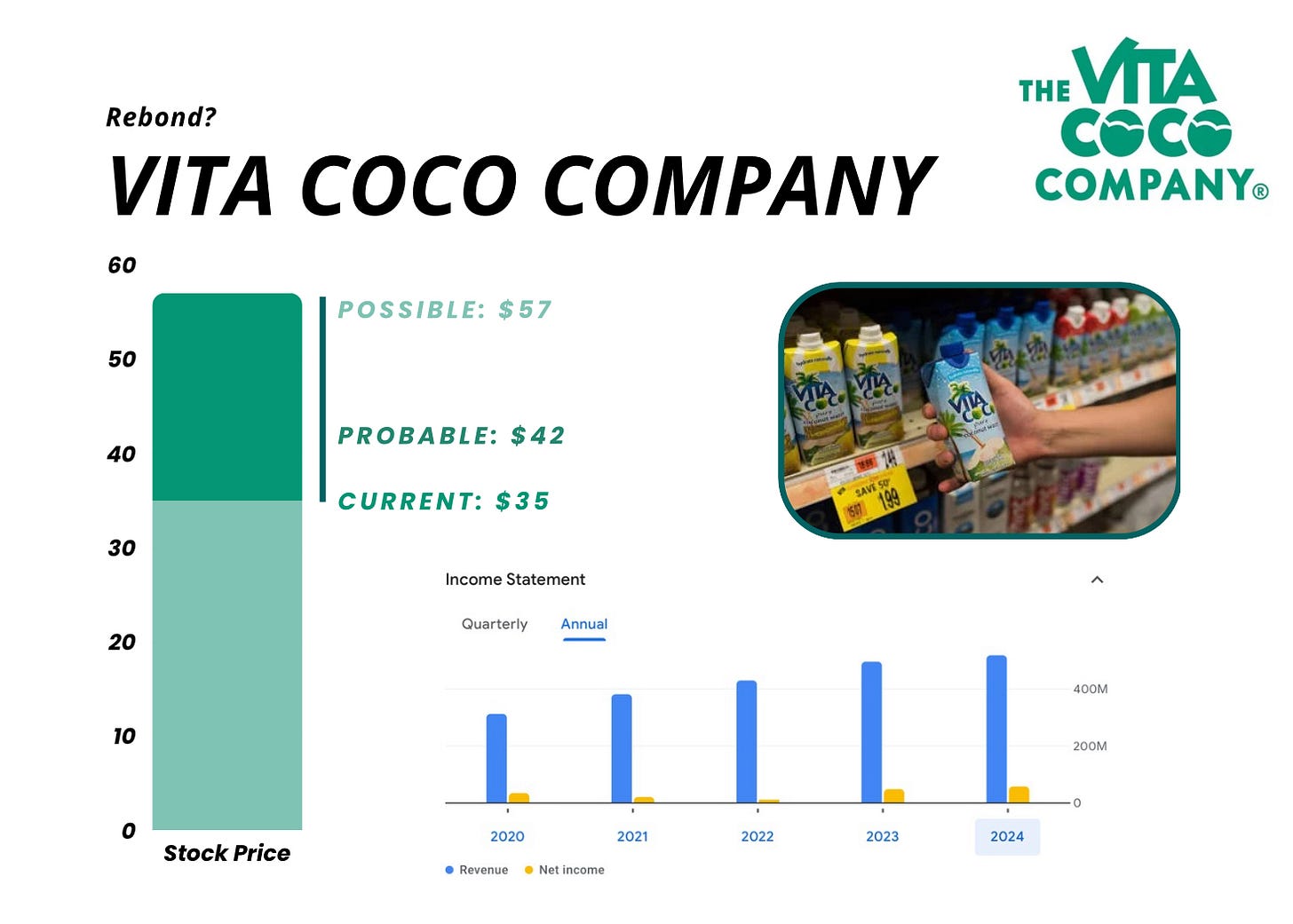

Vita Coco Company

Imagine sipping on a fresh coconut on a sunny beach. 🥥 Well, Vita Coco is kind of like that, but in stock market form. Currently trading at $35.48, it's well below its estimated value of $57.09. And guess what? They've recently raised their financial outlook for 2024, despite a slight dip in quarterly sales.

Not bad for a company that seems to have been a bit overlooked by the market, right? A real opportunity for those who believe in a good bounce-back. The market for healthy and natural beverages continues to grow, which could benefit Vita Coco in the long run.

Zscaler

→ Disclaimer, by the time I started this article and continued on it, Zscaler grew +17%…So I had to modify a bit the numbers:

Let's switch gears to something a bit more techy with Zscaler. Specializing in cloud security, this company is like the bodyguard for your data. At $270 $296.32, it's trading well below its estimated value of $290 $330.87. Why this much? The company still has potential:

With recent integrations (CrowdStrike) boosting its security offerings, Zscaler might just be the tech gem you're looking for. With the rise in cyber threats, companies like Zscaler, which offer advanced cloud security solutions, are well-positioned for continued growth. There is Palo Alto, yes. But there is space for many company on this field.

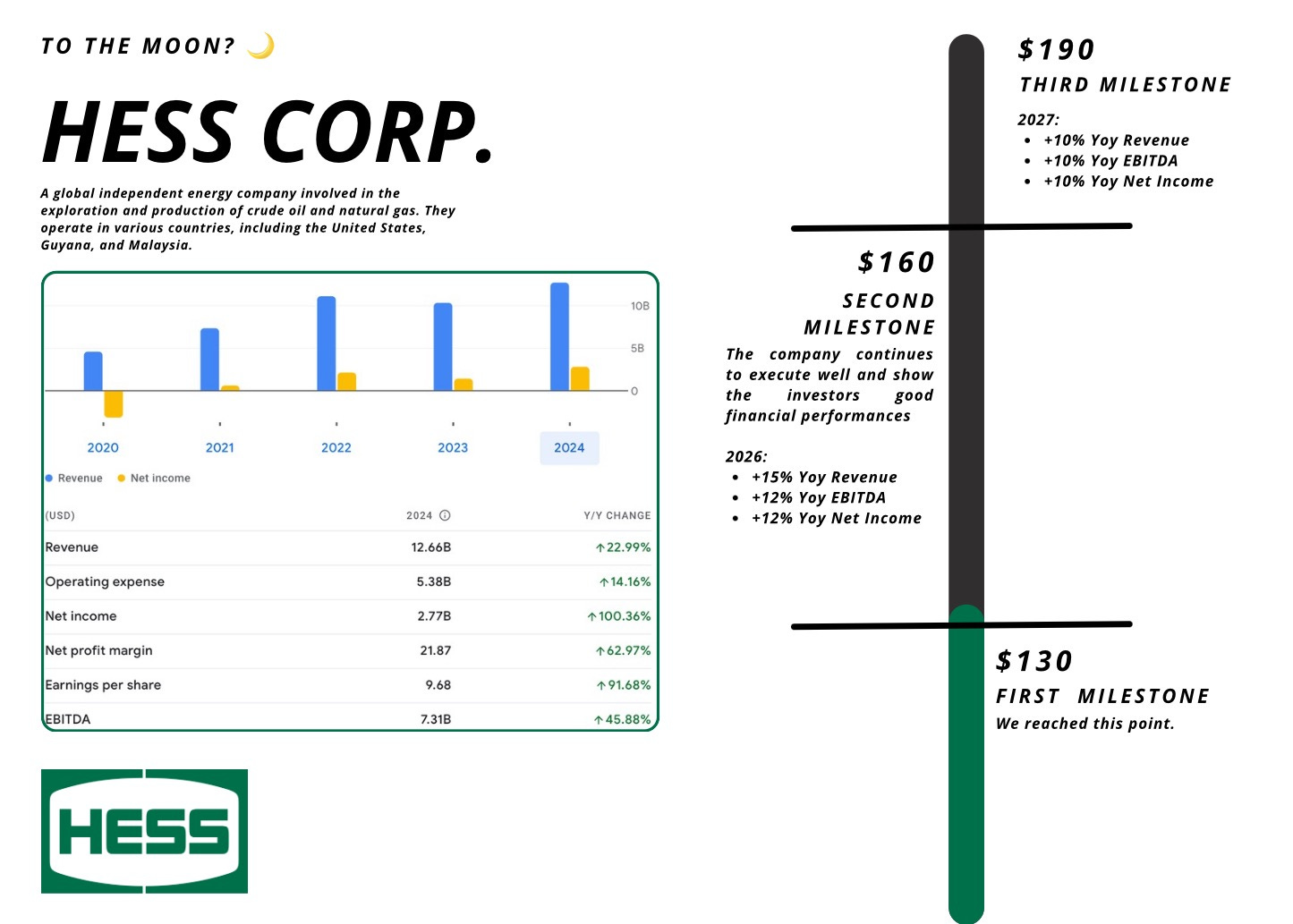

Hess Corporation

Hess Corporation is like the old sea wolf of the energy sector. Despite market challenges, they're sticking to their growth forecasts. A solid company with long-term prospects intact and currently undervalued.

Perfect for those looking to bet on an energy rebound. The energy sector, though volatile, remains crucial to the global economy. Continued investments in renewable energy and green technologies could offer long-term growth opportunities for Hess.

Rest of the story? It’s for Paid Subscription. If you like my work and want to support it, consider becoming a Paid Subscriber.

Celanese Corporation

Celanese is a bit like the chameleon of the chemical sector. 🧪 They've beaten expectations for the first quarter but remain undervalued. A real opportunity for those who love companies with solid performance but still attractive valuations. The demand for specialized chemical products remains strong, which could support Celanese's future growth.

VSE Corporation

VSE Corporation is a bit of an underdog that might just surprise you. With an estimated value of $141.73 but trading at $100.01, they've seen a bit of a dip, but earnings are expected to grow substantially. Definitely one to watch closely. Despite recent shareholder dilution and lower profit margins, VSE anticipates substantial growth in earnings, indicating a potential transition to more robust future growth.

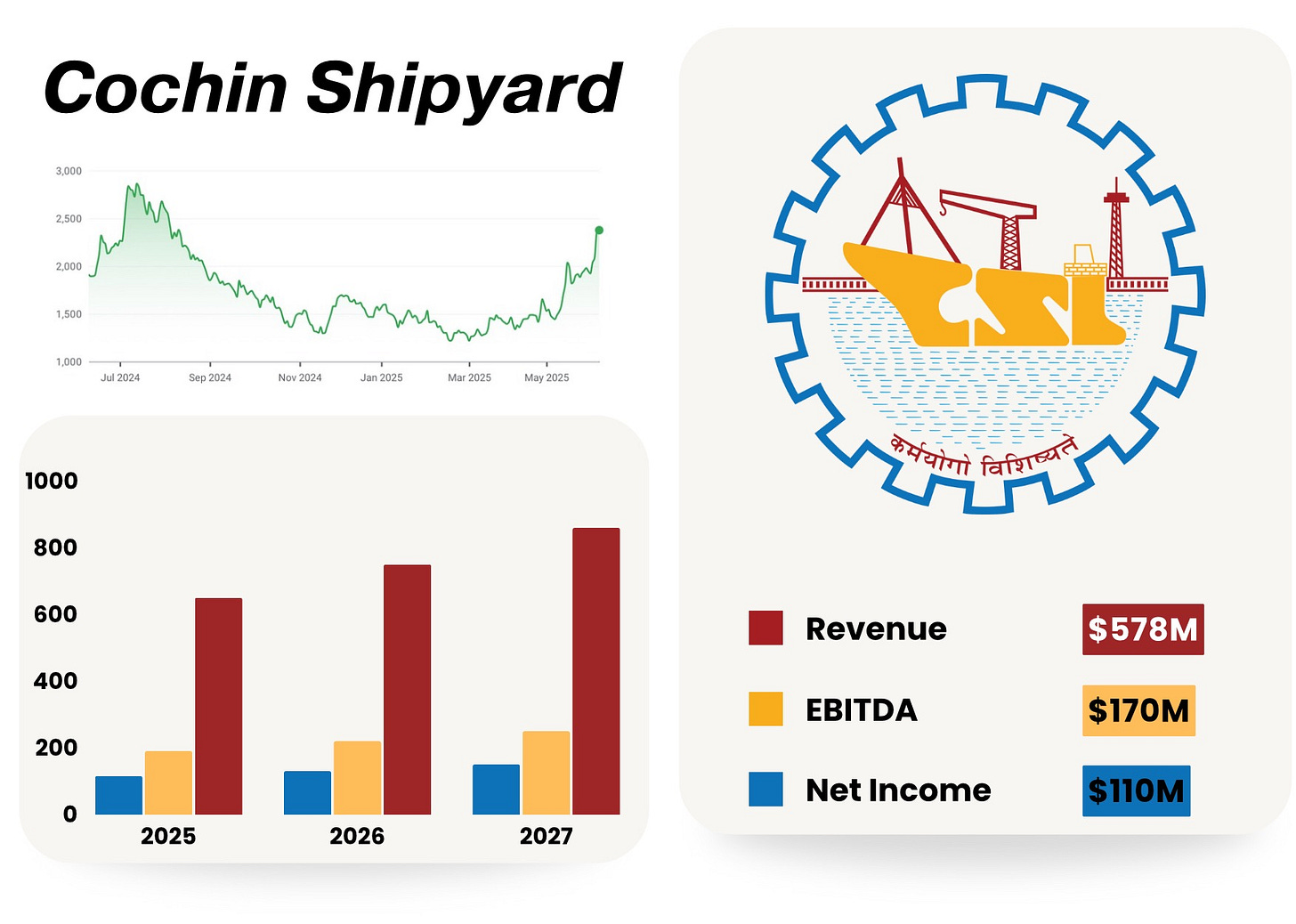

Bonus: Cochin Shipyard

Finally, Cochin Shipyard is like the phoenix rising from its ashes. With a drop of over 50% from recent highs, they're showing signs of a potential rebound. With the Indian government pushing for self-reliance in defense manufacturing, this company could be ready to take off again. ⚓️

With continued government support for self-reliance in defense manufacturing, Cochin Shipyard could benefit from increased orders and investments in the naval defense sector.

So, ready to add a bit of dynamism to your portfolio? These companies, though undervalued, show promising signs. Do you want me to make a specific deep dive on one of these? If yes:

This analysis is for informational purposes only and does not constitute financial advice or investment recommendations. Investing in financial markets involves risks, including the risk of loss of capital. Always do your own research or speak with a qualified advisor.

Love the rundown here—great mix of under-the-radar plays across sectors. Vita Coco and VSE are particularly intriguing from a value/rebound angle

Cochin Shipyard